What is the Stock Market? (for absolute beginners)

In this article, I will explain the basics of the stock market. We will try to put some light on how stocks are bought and sold. Let’s move forward.

Acc. to Wikipedia, ” A stock market, equity market or share market is the aggregation of buyers and sellers of stocks, which represent ownership claims on businesses; these may include securities listed on a public stock exchange, as well as stock that is only traded privately. “

For absolute beginners, the above definition may seem like Greek. So, we have tried to explain the stock market in a story – format. Give it a look.

The Startup

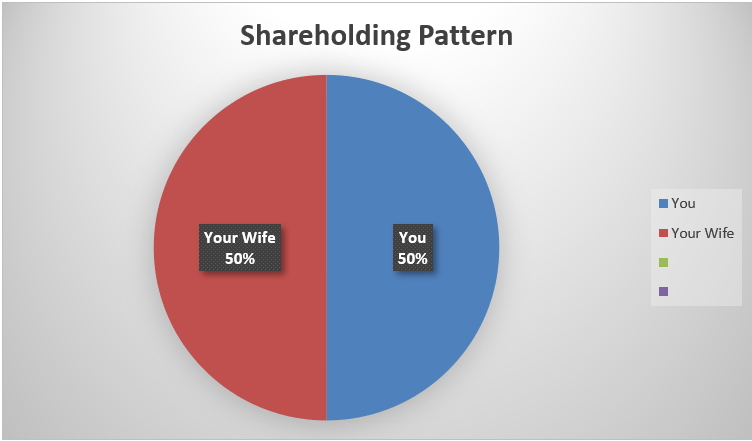

We will start at the beginning. Suppose you got a wonderful idea to start an ice-cream business. After discussing it with your wife, you opened a shop by putting all of your savings into it. Here, your wife and you have 50-50 % ownership(shareholding) of this business because you both have poured money into this thing.

Expanding in the City

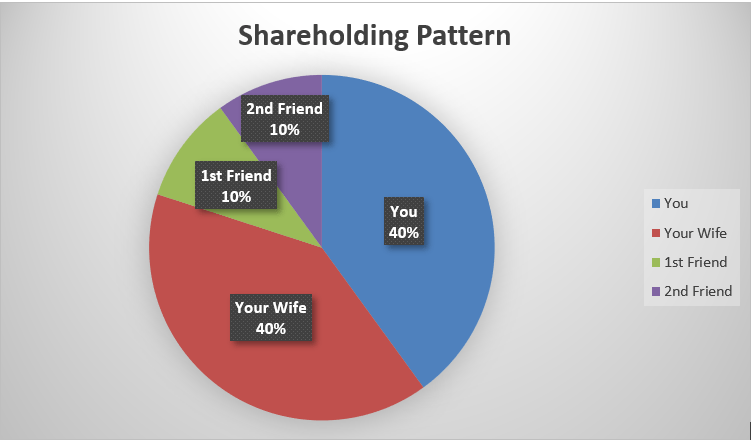

Thankfully, the business worked and now you are thinking of expanding your outlets to other parts of the city. But you don’t have enough money. So, you approach some of your wealthy friends and ask them to invest in your venture. For gaining their trust, you show them your profit and loss statements along with some other crucial business documents.

Two of your friends agree to invest around $10,000 each for the expansion project in return for some share in your business. You don’t have any other option, so you agree and give a 10 % share of your business to both of them.

Now, there are four owners of the Ice Cream business you had started and the shareholding pattern of your business venture is:

Here, your wife and you are majority shareholders whereas your friends are minority ones. Hence, in all the crucial business decisions, you guys will have a bigger say.

State Wide Expansion

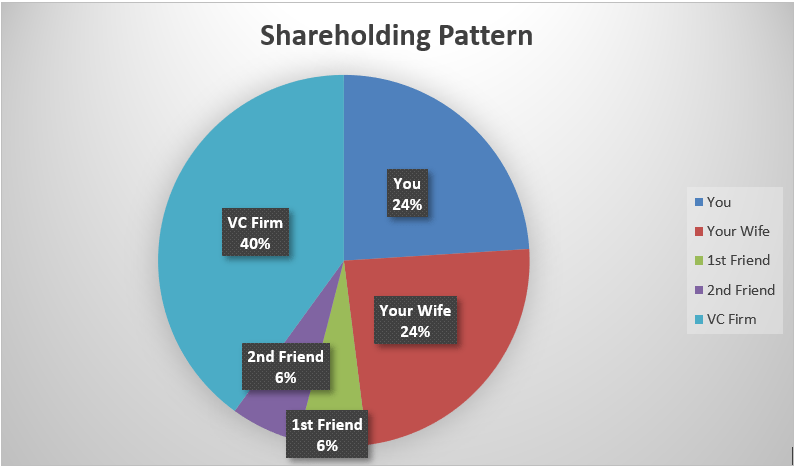

Your idea is really amazing and ice – cream business is growing like anything. So, you along with other shareholders plan to take it to another level, i.e. expansion into the whole state.

To fund this, you shake hands with some big guys (Venture Capital Firms). Your wife presents the idea and with the opening of champagne bottles, a deal is signed which will give them 40% ownership of the business in return of $10,00,000 investment.

This way, the business gets funds and some new owners who provided the funds. The new shareholding pattern will be:

A Twist

Everything is going fine. The business is undergoing expansion. New outlets are being opened all around the state. Suddenly, your friends want to sell their share of the business because they see no future scope of growth in it. But, you have opposite beliefs and hence, agree to buy their stake (share).

This way, they exit out of the company and your ownership increases in return of money. Actually, this type of activities is normal in big businesses or companies. In fact, here, we have tried to simplify the situation by taking the case of just five investors but this number can largely increase even in case of private limited companies.

Final Shot – Stock Market

Days transformed into months. Months into Years. Everything is going well. The business has gained a strong foothold in the state and good brand name. But, the profits growth is starting to slow down. So, you guys come up with another expansion plan.

Wait Wait! If you are pondering how a person can get this smart and sharp. Then, start reading books. I have listed some reasons here to regularly keep learning. Give them a look later. Let’s move on for now.

The Grand Plan to expand all around the country. It was no way an easy task and the funding required was just too much for a single investor. Not finding any other way to get the funds. You decide to make the company a public limited one i.e. to take it to the stock market and ask for the funding there.

Hot Read: Why I am an Atheist? | A Logical Explanation

Definition

Actually, the Stock Market is just like any other market where people buy and sell shares of various companies and the price is determined by their demand and supply. When companies achieve a very vast size. Then, it gets very hard for a bunch of people to fund its further growth activities. So companies go to the stock market where even the normal public can buy some share in that company.

Concept of Shares and Valuation

This provides easy funds for the company and ownership to even tiny investors in big businesses. Thousands of investors invest in various companies through the stock market. So, companies usually divide the shareholding percentage (we had discussed earlier) into a specific number of shares for easy distribution among investors.

eg. Shareholding of a $100,00,000 company can be divided into 100,000 shares of $100 value each. (No. of shares * Value of each share = Valuation of the company)

The numbers of issued shares usually stay the same all the time but the value of each share keep changing from time to time on the basis of demand and supply. This directly affects the company’s valuation.

This is enough for now. We will bring clarity to more concepts of the stock market soon. Till then, read How to become a better investor?

This Post Has 0 Comments