Should I get a Loan | Home Loan Analysis

When you don’t have any money but still want to buy a house. Yeah! a Real House. Then Home Loan Companies come handy. They sometimes ask for a Bank Mandate (to automatically deduct the Repay Installment) and may even ask for some security deposit if you have a bad Credit Profile. But, sooner or later, you will get a Home Loan (if you want).

Unlike a Personal Loan, Home Loans don’t issue the Lumpsum. They generally provide the money as we construct our house. So, Bank officials will occasionally visit the site to check the Construction Work and then give Capital as needed. But, in case, you are buying a Ready Made House, then it just goes on like any other type of loan.

Case Study for Housing Loan (in India)

Reiterating the same situation, if you don’t have money and want to buy a house. Then there are two possible solutions. Either, go for a Home Loan (Quick and Common One) or Save the Money (Hard and Rare One).

Pardon me if you are not familiar with INR (Indian National Rupees). I will primarily use that in my calculation but will try to quote dollar value in brackets. Still, It will be an interesting case study. You just need to capture the Main Idea behind it.

Suppose there are two men – Ron and Sid. Both of them want to buy an apartment but don’t have money. So, Ron opts for a home loan. While Sid decides to first Save Money and then buy the house.

A little Clarity Session

It’s an assumption driven Case Study. Keep it in mind promptly. Actually, I have discussed this strategy with some brilliant minds earlier also. And each time I was faced with a ton of questions because this study seems just too good to be true.

Later in the article, I will answer them for you. So, this reading will be productive and the comment box will be tidier.

Home Loan Route (Ron)

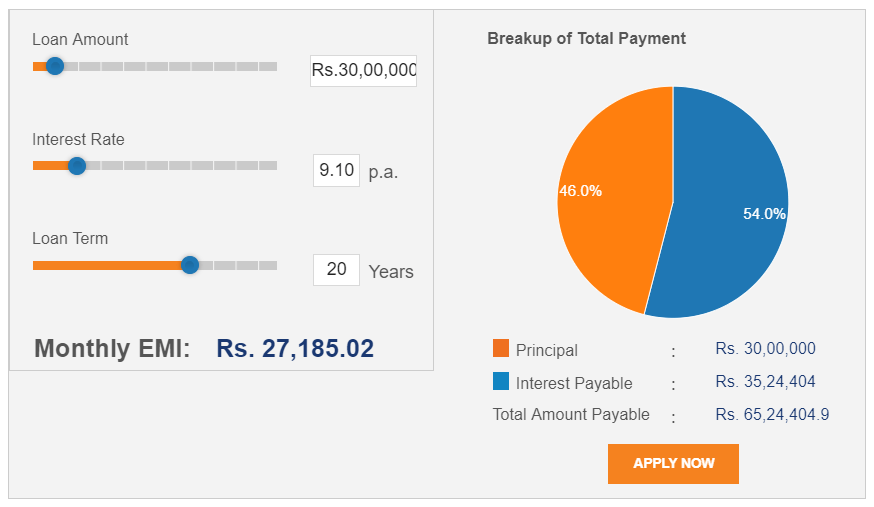

In the outskirts of Mohali (a city in Punjab, India), you can buy an apartment for 30 Lakh Rupees (around $43,000). Acc. to ongoing Interest Rates. Even if you have a good credit score, they will make you pay around 9.10% interest per annum.

So, if Ron takes a Home Loan of 30 Lakh Rs. for a period of 20 years at 9.10% per annum. Then, he will end up paying close to 65 Lakh (around $93,000) in the end. His EMI will come around Rs. 27000 (around $400). After paying the EMI and all other monthly expenses each month, Ron will have no other money left.

Take a look at the following visual from a reputed bank’s website.

Don’t go after the $400 monthly EMI. It may seem like a small number. But, here in India, most middle-class people earn this much only.

So, by opting for a home loan, Ron will pay around 35 Lakh Rupees in Interest (during 20 year Loan Tenure). And, in the end, he will be left with a small old APARTMENT.

Alternative Approach (Sid)

Sid is a smart guy. He hates to donate any money to Banks. So after figuring out the Home Loan thing. For comparison purpose, assume that Sid also saves Rs. 27,000 each after all his expenses.

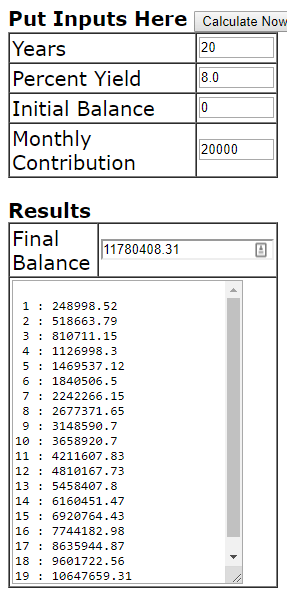

So, Instead of buying, he actually rents the same apartment for Rs. 7000 ($100) per month. And decides to start a SIP of Rs. 20,000 ($287) with the rest of the money.

He invests in a debt fund. And the fund consistently returns 8% interest per annum for the next 20 years. Even If you don’t believe that anybody can get 8% average in the last 20 years, still keep reading (your doubt will be clear soon).

These tips to become a Better Investor can help for sure.

With this, he finally accumulates a total of 1 Crore 17 Lakh Rupees ($1,68,292). It’s a decent amount of money to buy a HOUSE today. Look at the calculator below.

Back to Reality (Questions)

Calm Down! depending on your experience with finance. There must be questions arising about the validity of this calculation. These questions will range from returns to the consistency of SIP deposit. Let’s discuss them one by one here.

Is the assumption of 8% average returns valid?

In my country, 8% is really an easy return rate. Maybe it won’t be the case for you. But, Keep in mind that with the change of Debt Fund Interest Rates, Home Loan Rates also vary. So, you basically don’t need to harness the same 8% return in order to replicate my assumption in reality. Let’s take a look at two situations below.

In India

In the last 20-year history of Indian Markets, even Fixed Deposits have delivered an average 8% return. Equity Funds have broke 25% average for these 20 years.

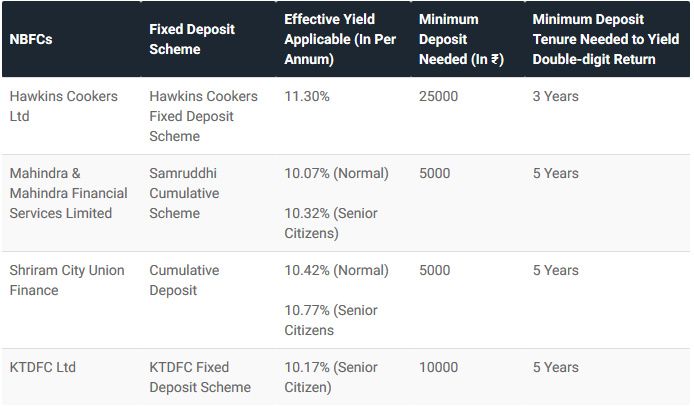

At present, Fixed Deposit in Bigger Banks will offer around 7% yearly returns. But, if you go to an NBFC, then you will get more than 9% in India.

Similarly, if we talk about home loans, their rates are around 10% per annum on an average. So, these are close to Debt Fund returns (opted by sid).

If you want to know why Loan Rates rise with the FD rates, read this.

In the USA

Govt. backed assets provide around 2.5% returns per annum. And typically home loan rates lie around 4.5%. This is a completely different Scenario.

So, it will be fallacious if we discuss both scenarios on the Interest Rate basis. Actually, to get the benefits of the alternative approach, We don’t need to reach 8% interest rate. Because we are harnessing the power of compounding effect and consistency.

Hot Read: Why I am an Atheist? | A Logical Explanation

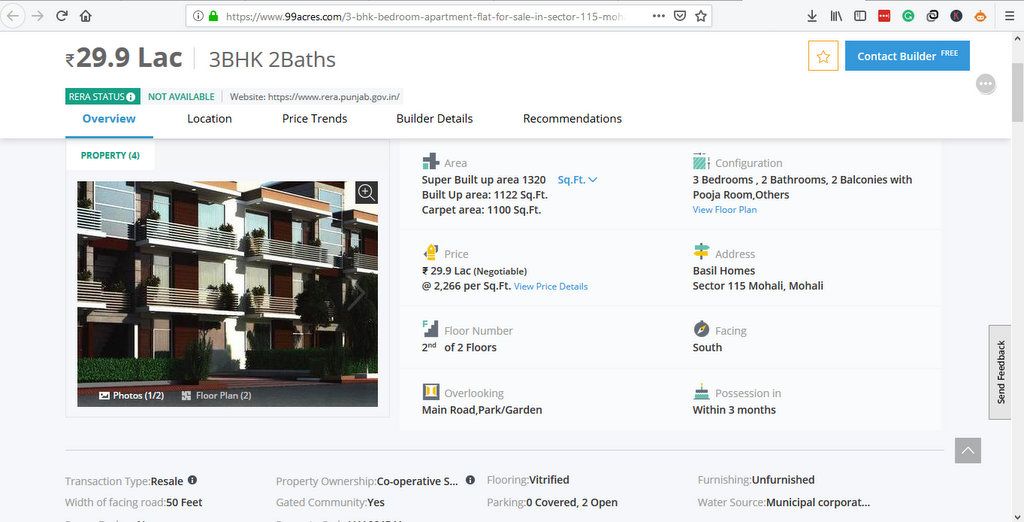

An appartment for Rs. 30 Lakh ($43,000)?

At my place, It’s possible for sure. And in many other cities too there will be Apartments available in this range (around 30 Lakh Rupees).

Actually, it just depends on the locality of the house to be bought. If you go out and search for an apartment in your city’s outskirts. Then you will get cheaper apartments. While the opposite will be true for City Centers.

Take a look at one listing below on 99acres.com.

Can a middle-class Indian save Rs 27000 each month?

This assumption is most prone to questions. Because, In semi-urban India, most people have an income of around Rs. 10,000 ($144) per month only. So, how can they save Rs 27,000 with their day job?

Actually, They don’t need to save that much to buy a 2 BHK apartment. It just depends on the apartment’s location as I had discussed in the last point.

In Semi-Urban area, you can build a beautiful HOUSE with Rs. 30 Lakh. And in a rural area, people have built VILLAS with Rs. 30 Lakh. Leave apart a tiny 2 BHK Apartment.

Just remember, Inflation (i.e. Real Estate prices) of an area vary with the Average Income of people. In my assumption scenario, We have talked about an apartment in Mohali, India. It’s a commercial hub. Here, Ron has bought a 2 BHK Flat for Rs. 30 Lakh. And Sid is paying Rs. 7000 as its rent.

In the real world, this will not stay exactly the same for every location in the world. But, the figures will be relatable unless you are living in a really expensive real estate market.

So, a Middle-Class Indian will have other options available and is not supposed to save Rs. 27000 each month to buy an apartment. By the way, we are comparing the home loan with savings route. So, if that person can’t save enough money to pay the EMI then question won’t arise to start saving for direct Saving.

Can they consistently pay for 20 years?

Acc. to my assumption, Ron and Sid will keep paying EMI and SIP each month. But, this may not be the case in the real world because of various other factors. A recession can hit our World or there might be a personal problem (like illness or car accident).

Anything of this sort will impact the consistency of Payment that I assumed earlier in my fictional case study. I agree to this point but still, the Alternative Approach taken by Sid will be a better option.

Actually, the factor of Financial Security comes to play at this point. Suppose, some macro-level bad scenario (recession, etc.) happens. As, both the assumed characters (Ron and Sid) are living in the same locality. So obviously, they will be impacted to the same level.

Both of them, lose their jobs. Now Ron will be badly stuck with no Savings and a load of Rs. 27,000 which he needs to pay each month for the Home Loan EMI. On the other hand, Sid can use the money he had saved (to pass through this bad time).

Actually, Sid just needs to pay Rs. 7000 (apartment rent) to keep living in that place. This amount is small and can be arranged quite easily in comparison with the Rs. 27,000 EMI (of Ron’s Financed Apartment).

So, even if they aren’t able to pay rent consistently. Sid will be in a better position as a whole.

I wonder that People are still unknown about Credit Cards. Read here.

Inflation will spoil Sid’s Plan?

Again, it just depends. Most probably, the Real Estate Inflation will stay stable. Else in a rare case, there can be two things – Either the Real Estate Prices will sky-rocket or break the ground.

If they skyrocketed, Ron will be a Super – Hero because Sid will pay more rent (than Rs. 7000) and also need to spend more when he finally buys the apartment.

The opposite can also be true. If the Real Estate prices touch the ground then Sid will pay less rent and also spend less when he buys the apartment.

Actually, rare cases have a specialty, they don’t occur too often. So, it’s not wise to debate or discuss them in this generic assumption.

If everything stays fine and Inflation rises on a stable rate then Debt Fund Interest rates will also rise. So, Sid will be forced to pay a little more but he will also get a little more in Debt Fund interest. Hence, it will cancel out the Inflation effect.

Ending Words

Does, the Home Loan still seems beneficial to you? Let’s discuss further in the comments. I am waiting for you there 😀

Do you know? Proper Financial Planning is essential to stay secure in our life. Else, rare case scenarios can through you on the floor anytime. Read this simple yet effective guide to ready yourself for financial uncertainties.

This Post Has 0 Comments